Car Dealership Financial Management

Your Essential Guide

- Introduction

- Key Performance Indicators for Car Dealerships

- Dealership Accounting Best Practices

- Managing Cash Flow & Working Capital

- Tax Planning & Compliance

- Leveraging Dealership Management Systems

- Profitability Strategies

- Accounting Resources for Car Dealerships

- Contact Brady Ware

Introduction

Car dealerships operate within a complex financial landscape that presents unique challenges, necessitating meticulous management to ensure profitability and compliance.

Unique Financial Challenges Faced by Car Dealerships

One of the primary financial challenges is floor plan financing, a common practice where dealerships finance their vehicle inventory through short-term loans secured by the vehicles themselves. This arrangement requires careful cash flow management, as interest accrues on unsold inventory, incentivizing dealerships to sell vehicles promptly to minimize financing costs. Effective inventory management is crucial in this context; maintaining an optimal balance between new and used vehicles can help reduce holding costs and ensure that high-demand models are readily available, thereby enhancing profitability

Additionally, dealerships must navigate the complexities of manufacturer incentives and state tax obligations. Manufacturer incentives, such as bonuses for meeting sales targets, can significantly impact revenue but often come with stringent compliance requirements. State tax obligations vary widely and can include sales tax collection, property taxes on inventory, and other regulatory fees, all of which require diligent compliance to avoid legal repercussions.

Importance of Sound Financial Management for Long-Term Profitability and Compliance

Robust financial management is essential for car dealerships to maintain profitability and adhere to regulatory standards. This encompasses accurate bookkeeping, effective expense tracking, and strategic financial planning. Regular financial analysis enables dealerships to identify profitable areas, manage costs effectively, and make informed business decisions. Moreover, with increasing scrutiny from tax authorities, maintaining precise financial records and implementing strong internal controls are vital to minimize audit risks and ensure compliance.

Scope and Audience of This Guide

This guide is tailored for dealership owners, general managers, CFOs, controllers, and in-house accountants responsible for overseeing financial operations. It aims to provide practical insights and best practices specific to the automotive retail sector, covering topics such as internal controls, reporting accuracy, and strategies for future expansion. By addressing these areas, the guide seeks to equip financial decision-makers with the tools necessary to navigate the industry’s unique challenges effectively.

Independent Dealerships

Independent dealerships, by contrast, are not tied to a specific automaker. They generally deal in used vehicles, which they may purchase at auctions, from trade-ins, or directly from consumers. Because they are not contractually bound to a manufacturer, independents have much more operational freedom.

Independents can set their own prices, create their own marketing materials, and decide which cars to buy and sell based on local demand. Their business model thrives on flexibility and cost-efficiency. Without the burden of meeting manufacturer standards for facilities or sales quotas, they often operate in lower-cost locations and are better able to adapt to market fluctuations.

However, this autonomy comes at a price. Independent dealerships lack access to new inventory and cannot offer manufacturer warranties or participate in CPO programs. They also typically have fewer in-house financing options and must establish partnerships with third-party lenders, which might mean higher interest rates for consumers. Some independent dealers offer “buy here, pay here” financing, catering to subprime borrowers, but this increases credit risk and demands robust collections infrastructure.

Another challenge is the perception of trust. Franchise dealerships benefit from brand reputation and manufacturer-backed guarantees, while independents must work harder to build consumer trust, often relying on online reviews, word-of-mouth, and transparent pricing models. Some have addressed this by offering in-house warranties and vehicle certification programs, but these can vary in quality and reliability.

From a financial management perspective, independents must be especially disciplined. Because they lack the resources and credit lines of large franchise operations, they are more vulnerable to market shocks, cash flow disruptions, or inventory mismanagement. A single bad auction purchase or unexpected downturn in used car demand can severely impact the bottom line.

Revenue streams: vehicle sales, F&I (finance and insurance), service and parts

Auto dealerships rely on a diversified set of revenue streams that, when balanced and well-managed, create financial stability and long-term profitability. The three primary pillars of revenue generation in the dealership model are vehicle sales, finance and insurance (commonly referred to as F&I), and service and parts operations. Each stream has its own unique role, financial profile, and strategic importance.

Vehicle sales remain the most visible revenue stream and often account for the largest portion of gross revenue at a dealership. This includes the sale of both new and used vehicles. Franchise dealerships benefit from manufacturer relationships that provide access to new inventory, allowing them to meet consumer demand for the latest models. However, margins on new vehicle sales are typically slim, especially when accounting for price competition, manufacturer-imposed pricing guidelines, and the costs associated with floor plan financing. Manufacturers do offer volume-based incentives, dealer holdbacks, and bonuses that help bolster net profit on these transactions, but reaching the thresholds to qualify for those incentives often requires strategic inventory management and high sales volume.

Finance and insurance (F&I) is a critical revenue center that often produces more profit per transaction than the vehicle sale itself. Once a customer agrees to purchase a vehicle, they are typically transitioned to the F&I department, where finance managers present a variety of loan and lease options, extended warranties, GAP insurance, vehicle service contracts, prepaid maintenance plans, and other ancillary products. The dealership earns income through reserve—by marking up interest rates offered by third-party lenders—and through direct profit on F&I product sales.

The service and parts department, often referred to as fixed operations, represents a dealership’s most consistent and recession-resistant revenue stream. This department includes mechanical repairs, warranty service, routine maintenance, parts sales, and, in some cases, collision repair. Unlike vehicle sales, which fluctuate based on market conditions, interest rates, and inventory levels, service and parts revenue tends to be more stable due to the ongoing needs of vehicle owners. Franchise dealerships typically service vehicles that are still under manufacturer warranty and are reimbursed by the OEM for those repairs, while also attracting customer pay work such as oil changes, brake jobs, diagnostics, and scheduled maintenance. Fixed ops profitability is enhanced by parts sales, which are marked up significantly over cost and used both internally (in service bays) and externally (to walk-in or wholesale parts customers). A key performance metric in this area is service absorption, which measures how much of a dealership’s overhead is covered by the gross profit from service, parts, and body shop operations. A high service absorption rate reduces the dealership’s reliance on unpredictable vehicle sales and contributes to overall financial resilience.

In today’s dealership environment, successful operations depend on an integrated approach to all three revenue streams. Vehicle sales drive traffic and generate initial profit, F&I maximizes margin on each sale, and service and parts sustain customer relationships while producing stable income over the long term. Digital transformation, evolving customer expectations, and tighter margins continue to shape these areas, making data-driven management, regulatory compliance, and customer experience more important than ever.

Key Performance Indicators (KPIs) for Auto Dealerships

In the automotive retail industry, Key Performance Indicators (KPIs) are essential for tracking dealership performance, identifying operational bottlenecks, and driving strategic decisions. Dealerships, whether franchise or independent—rely on a robust set of financial and operational KPIs to manage everything from inventory turnover to service department productivity. These metrics allow owners, general managers, CFOs, and sales teams to stay aligned with business goals and industry benchmarks.

Gross Profit Per Vehicle Sold (GPVPS)

This ratio identifies how much profit is earned, on average, from each sale after deducting cost of goods sold (COGS). Typically, used car sales are calculated separately from new car sales. To determine this amount, divide the total gross profit into the number of vehicles solid. This metric helps management determine pricing effectiveness and the impact of incentives or discounts.

Inventory Turnover Rate

This ratio identifies how often a dealership sells and replaces inventory over a specific period (monthly, quarterly, annually). It is calculated by dividing the cost of vehicles sold divided by the average inventory value. A higher value reflects an efficient inventory management strategy. Franchise dealerships typically aim for 12–15 turns per year, while independent dealers may range from 8–12 depending on location and demand.

Floor Plan Interest Expense as a % of Sales

Floor plan financing is a core part of dealership operations, particularly for franchises. This KPI shows how much interest the dealership is incurring relative to total sales, helping to identify whether holding costs are affecting profitability. It is calculated by dividing the total floor plan interest divided by total sales and then take the total and multiply by 100. A higher value indicates slow-moving inventory which may require immediate attention.

F&I Gross Profit Per Vehicle Retail (PVR)

This tracks profitability from Finance & Insurance (F&I) products like extended warranties, GAP insurance, and dealer-arranged loans. F&I is a major revenue source, often generating higher profit margins than the actual vehicle sales. It is calculated by dividing total F&I gross profit divided by number of vehicles sold. High performing dealerships can average between $1,200 to $1,600 in F&I income.

Closing Ratio

This ratio helps to assess the performance of the sales function. It evaluates the percentage of visits that turn into vehicle sales. It is calculated by dividing the number of sales divided by number of ups and leads and then multiply it the total by 100. Typically closing ratio ranges between 15% -30% with higher ratios indicating an more effective sales team.

Key Auto Dealership F&I Metrics to Track

- Per Vehicle Retail (PVR) – PVR measures the average gross income earned from F&I products per vehicle sold. The current national average ranges from $1,700 to $1,900. Understanding your PVR in comparison to the industry standard can help identify areas for improvement.

- Products Per Deal (PPD) – PPD tracks the average number of F&I products sold with each vehicle deal, typically between 1.3 and 1.7 products. Segmenting PPD data by deal type (finance, lease, used, and EV) and by individual F&I managers can provide valuable insights into sales strategies and performance.

- Product Penetration – Product penetration measures the percentage of vehicle deals that include at least one F&I product. Industry averages are 46% for service contracts, 45% for GAP insurance, and 17% for prepaid maintenance. These benchmarks help you assess how effectively you’re selling F&I products.

Dealership Accounting Best Practices

A well-designed chart of accounts (COA) is foundational to effective accounting in the auto dealership industry. Unlike generic business models, dealerships have unique revenue streams, inventory considerations, floor plan financing structures, and department-specific operations that must be accounted for accurately. A COA tailored for auto dealers allows business owners to track performance at a granular level, maintain compliance with industry regulations, and make data-driven decisions.

For dealership owners, the first step in customizing a chart of accounts is to organize it by major profit centers, typically new vehicle sales, used vehicle sales, parts, service, and F&I (finance and insurance). Within each category, it’s critical to break down accounts into subcategories that reflect key revenue and expense items. For example, the new vehicle department should include separate accounts for gross sales, manufacturer incentives, floor plan interest, commissions, and advertising expenses. Likewise, the parts department should distinguish between wholesale parts sales, internal parts usage, and retail parts sales.

This level of detail enables better benchmarking and profitability analysis, especially when comparing performance against industry standards like those published by NADA (National Automobile Dealers Association). In addition, by segregating variable and fixed expenses, owners can gain clarity on cost structures and make smarter budgeting decisions.

Proper COA design also improves tax planning, audit readiness, and lender reporting. Lenders, for example, often require departmental statements, and a well-structured COA facilitates clean reporting without manual adjustments. It also streamlines monthly closings and enhances communication between accounting and operational departments.

Many dealerships use Dealer Management Systems (DMS) like Reynolds & Reynolds, CDK Global, or Dealertrack, and aligning the COA with the DMS configuration helps ensure consistency between operational and accounting records. Finally, it’s wise to consult with a CPA or accountant, such as Brady Ware, who specializes in dealership accounting to review the structure periodically. As dealership operations evolve—whether through expansion, inventory mix changes, or shifts in manufacturer programs, the COA to keep financial reporting accurate and useful.

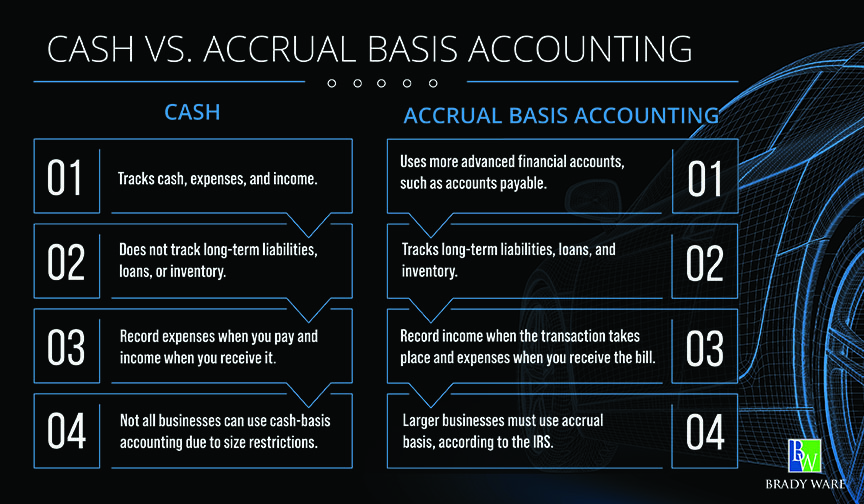

Accrual vs. Cash Accounting

The choice between accrual and cash accounting has significant implications for how auto dealership owners manage, report, and interpret their financial performance. Understanding the differences—and knowing which method best suits your dealership’s operational and tax needs—is critical to sound financial management.

Accrual accounting recognizes income when it is earned and expenses when they are incurred, regardless of when cash is exchanged. For dealerships, this means vehicle sales are recorded at the time of delivery, not when the customer pays in full, or financing is approved. Similarly, costs like floor plan interest, warranty claims, or vendor invoices are recorded when they are incurred—not when the check is written. Accrual accounting provides a more accurate picture of profitability and financial position because it matches revenues and expenses in the same period. This is particularly important for dealerships, where large transactions, parts and service revenue, commissions, and manufacturer rebates can span multiple reporting periods.

Cash accounting, on the other hand, records revenue only when cash is received and expenses only when cash is paid. While this method is simpler and can offer short-term tax deferral benefits, especially in the early stages of a dealership—it often fails to reflect true financial performance. For instance, if a dealer sells a high number of vehicles in December but doesn’t collect payment until January, cash basis accounting would understate revenue in one period and overstate it in the next. This can distort operational insights and make it harder to plan or obtain financing.

Most established dealerships use accrual accounting because it aligns with generally accepted accounting principles (GAAP) and is often required by lenders and manufacturers. Additionally, the IRS generally requires accrual accounting for dealerships with inventory, unless they qualify under specific exceptions. However, some smaller or independent dealerships may still use cash accounting for tax purposes if they meet gross receipts thresholds and opt out of inventory capitalization rules under the Tax Cuts and Jobs Act.

Ultimately, while cash accounting may offer simplicity, accrual accounting provides the depth and accuracy needed to manage a dealership effectively. Many dealerships choose a hybrid approach—using accrual accounting for internal reporting and compliance, while leveraging cash basis accounting for specific tax strategies. Consulting with a CPA who understands dealership operations is essential to evaluating which method—or combination—is best suited for your dealership’s financial goals and tax strategy.

Reconciling floor plan financing and inventory accounting

Reconciling floor plan financing with inventory accounting is one of the most critical and complex aspects of auto dealership financial management. Floor plan financing, often referred to as inventory financing, allows dealerships to purchase vehicles for resale using borrowed funds secured by the inventory itself. Accurate reconciliation between your floor plan liabilities and your inventory assets ensures not only clean financial records but also compliance with lender agreements, accurate profit tracking, and risk mitigation.

At its core, reconciliation means ensuring that every unit financed through your floor plan is accurately recorded in both your inventory system and your general ledger. Each vehicle’s cost should be matched with its corresponding floor plan liability from the moment it’s received at the dealership. The purchase of the vehicle creates an asset (inventory) and a matching liability (floor plan payable). This dual entry must be carefully tracked as vehicles move through the sales process.

When a vehicle is sold, both the inventory asset and the floor plan liability should be relieved simultaneously. The dealer then repays the floor plan lender—usually within a short grace period to avoid interest or curtailments. If this process isn’t properly reconciled, it can result in discrepancies such as “missing” inventory on the books, overstated liabilities, or even misstated cost of goods sold.

To avoid these issues, dealerships should perform regular reconciliations—ideally monthly—between floor plan statements from lenders and internal inventory reports. Any unit appearing on a floor plan statement should also be reflected as in-stock inventory. If a unit is sold but still appears on the floor plan report, it may indicate a missed payoff or a delayed title release, both of which can lead to interest charges or regulatory issues.

Inventory accounting systems should be integrated with the dealership’s DMS to automate tracking and minimize errors. It’s also essential to maintain accurate costing for each unit, including additional expenses like transportation, dealer prep, or accessories, which should be capitalized into inventory. Failure to do this results in understated inventory and incorrect gross profit reporting.

Additionally, some dealers take advantage of floor plan interest assistance programs from manufacturers. Proper reconciliation includes tracking these credits as offsets to interest expense and ensuring they’re applied correctly. Floor plan audits—by internal staff or external CPA firms—are a valuable tool to verify inventory existence, validate collateral for lenders, and catch discrepancies early.

In short, clean reconciliation of floor plan financing and inventory ensures your dealership doesn’t pay unnecessary interest, remains in compliance with lender requirements, and accurately measures profitability. It also reduces audit risk and improves trust with financial stakeholders. Working closely with a dealership-experienced accountant or controller is key to maintaining the integrity of this crucial financial relationship.

Managing Cash Flow and Working Capital

Managing cash flow and working capital is a central focus for car dealerships because of the large capital investments tied up in inventory and the significant influence of external financing arrangements. Seasonal trends play a major role in shaping a dealership’s cash flow throughout the year. Typically, cash inflows are strongest during peak selling seasons, such as late spring and summer months, when consumer demand for vehicles rises. Conversely, cash flow often tightens during winter months, especially after the holiday season, when discretionary spending falls. Dealers must forecast these fluctuations carefully, building cash reserves or securing flexible lines of credit to weather slow periods without disrupting operations.

Optimizing inventory turnover is another vital strategy in cash flow management. Vehicles are depreciating assets, meaning that the longer they sit unsold, the more they cost the dealership through floor plan interest charges, insurance, and decreased market value. Dealers strive for faster turnover by using data analytics to stock the most in-demand models, closely monitoring aging inventory, and strategically discounting or wholesaling vehicles that are unlikely to sell at retail prices. High inventory turnover improves liquidity and reduces carrying costs, both of which strengthen the dealership’s overall financial health.

Floor plan financing, where dealers borrow against the value of their vehicle inventory, is a standard industry practice but must be carefully managed. Interest expenses on floor plans can significantly erode margins, particularly when interest rates rise, or inventory remains unsold for long periods. To manage floor plans effectively, dealers often prioritize selling older floor-planned vehicles before interest subsidies expire, negotiate favorable terms with lenders, and consider floor plan curtailments when necessary. Accurate reporting and monitoring are essential to avoid unexpected interest spikes and to maintain strong relationships with floor plan providers.

Balancing accounts payable and receivable is also crucial. On the accounts payable side, dealers should take full advantage of vendor payment terms without incurring late fees, thereby preserving cash as long as possible. On the accounts receivable side, they must aggressively manage collections, especially in the service and parts departments where customer and warranty receivables can age quickly. Offering electronic payment options, setting clear payment terms, and following up promptly on outstanding balances can speed up cash inflows. In combination, these efforts help ensure that dealerships maintain sufficient liquidity to fund operations, take advantage of purchasing opportunities, and meet financial obligations even during challenging sales periods.

Tax Planning and Compliance

Tax planning and compliance are critical for auto dealerships because of the unique financial structure of the business, particularly around inventory management and cost accounting. One of the most important tax considerations is the choice between the LIFO (Last-In, First-Out) and FIFO (First-In, First-Out) inventory accounting methods. Many dealerships historically favor LIFO because it allows them to match recent, higher vehicle acquisition costs against current revenues, thereby lowering taxable income in periods of rising prices. This method can offer substantial tax deferral benefits; however, it also requires compliance with the IRS’s LIFO conformity rule, meaning that if LIFO is used for tax purposes, it must also be reflected in the dealership’s financial statements. In contrast, FIFO can result in higher taxable income during inflationary periods but might provide a clearer representation of the actual flow of inventory, which could be important for management analysis or certain financing relationships.

Another major tax compliance issue for dealerships involves inventory tax rules more broadly. Dealerships must properly classify and value their inventory under tax law, especially given that vehicles can be new, used, part- or service-related items, each potentially subject to different tax treatments. Dealerships also must be aware of specific rules regarding uniform capitalization (UNICAP) requirements under Section 263A of the Internal Revenue Code, which dictates how certain indirect costs must be capitalized into inventory rather than expense immediately.

Additionally, state-level inventory taxes can impact tax planning. Some states impose a personal property tax on dealership inventory, while others provide exemptions or credits. Proper planning around year-end inventory levels, as well as any available elections or exemptions, can minimize these costs. Dealerships must also stay attuned to recent changes, such as the possible phase-out of LIFO conformity at the federal or international level or shifts in state tax law affecting inventory valuation.

Because of these complex and evolving rules, most dealerships benefit from working closely with tax advisors who specialize in auto dealership accounting. This ensures that the business not only maximizes its tax efficiency but also remains fully compliant with federal, state, and local requirements.

LIFO Strategies: Evaluate Your Key Factors

Continued low inventory levels are causing dealers to question using the LIFO inventory methodology. For 2021, inventory declines are generating significant taxable income, as the LIFO reserve deteriorates. Key factors—looming tax rate increases, continued supply chain struggles, and future inflation—must be evaluated when considering a possible change from LIFO.

What strategies are available to address this taxable income increase?

Discussions continue between industry advocacy groups, tax practitioners, and Treasury regarding relief from LIFO recapture using Internal Revenue Code §473. This provision in the tax law allows LIFO inventory levels to be restored over three years if the inventory liquidation was due to a qualified inventory interruption. Proponents believe the supply chain problems facing the automotive industry because of the COVID-19 pandemic qualify as a major foreign trade type of qualified inventory interruption. One strategy is to wait and see if Treasury approves the use of this provision. Many dealerships and their owners are discussing filing extensions on March 15 and April 15, 2022, with the hope this relief is granted.

Another option being considered is changing the LIFO methodology from the Alternative method to the Inventory Price Index Computation (IPIC) method. The Alternative and IPIC methods use different inflation measurement sources: the IPIC calculation relies on either the Consumer Price Index (CPI) or Producer Price Index (PPI). For 2021, the CPI is producing levels of inflation substantially greater than the Alternative method.

Changing from the Alternative method to IPIC requires a 5-year commitment – it’s an accounting method change under the federal tax rules and must be used for this amount of time before a taxpayer could switch back to the Alternative method. Additionally, all inventories – new vehicles, used vehicles and parts – must change to be valued using IPIC. If used vehicles were previously valued using lower of cost or market, any used vehicle write down must be reversed and pulled into taxable income over three years.

For 2021, dealerships likely would receive a substantial benefit from changing to the IPIC method. However, the question becomes how will the CPI/PPI indices fair over the next four years? Since 2002, many years have shown them to be negative (deflationary), which would result in an income pickup during that year. The decision becomes will the potential increase to taxable income in years 2-5 at arguably higher tax rates be less overall than the income pickup in recent years?

Understanding & Managing Sales Tax Obligations

The concept of “nexus” is fundamental to sales tax. Nexus refers to a connection between your dealership and a state that creates a tax obligation. This connection can be physical, like having a store, warehouse, or employees in a state. It can also be economic, triggered by exceeding a certain sales threshold within a state. Each state sets its own rules for establishing nexus, so it’s essential to research the specific requirements of every state where you do business, or where you anticipate doing business. Understanding where you have nexus is the first step in determining your sales tax obligations.

Common Ways Auto Dealers Trigger Nexus

In the normal course of doing business many auto dealers may engage in business activities that trigger a sales tax liability in another state. This can include delivering vehicles across state lines using dealership owned vehicles, maintaining inventory in another state through third party lots, selling online to out of state customers, employing remote salespeople, and using affiliate services in other jurisdictions. If the dealership engages in any of these activities it is very likely there are nexus issues to consider.

Registering for Sales Tax

Once you’ve determined you have nexus in a state, you’ll need to register with that state’s tax authority. This process typically involves obtaining a sales tax permit or license. You’ll need to provide information about your business, including its legal structure, contact details, and the products or services you sell. Most states offer online registration, making the process relatively straightforward. However, it’s crucial to register before you begin collecting sales tax to avoid penalties. Keep accurate records of your registrations and ensure you understand the ongoing requirements for each state.

Collecting Sales Tax Correctly

After registering, your responsibility shifts to collecting the correct amount of sales tax on taxable transactions. This involves identifying which products or services are taxable in each state, as some items may be exempt or taxed at different rates. You need to charge the appropriate sales tax rate based on the customer’s location, not your business location. This can be particularly challenging for online businesses that ship to multiple states. Using reliable sales tax software or consulting with a tax professional can help you accurately calculate and collect the correct amount of sales tax.

Filing Sales Tax Returns

Collecting sales tax is only part of the process. You also need to file regular sales tax returns with each state where you’re registered. The filing frequency varies depending on the state and your sales volume. Some states require monthly filings, while others may allow quarterly or annual filings. Your sales tax return will report your total sales, taxable sales, and the amount of sales tax you collected. It’s crucial to file your returns on time, even if you didn’t have any sales during the period, to avoid penalties. Many states now require electronic filing, so familiarize yourself with the specific filing requirements of each state.

Staying Compliant and Avoiding Penalties

Sales tax laws and regulations are constantly evolving. Staying up to date with these changes is crucial for maintaining compliance and avoiding penalties. Subscribing to tax newsletters, attending webinars, or consulting with a tax professional can help you stay informed. Penalties for non-compliance can be significant, including fines, interest charges, and even business license revocation. Proactive management of your sales tax obligations is essential for the long-term success of your business. By understanding nexus, registering appropriately, collecting and filing accurately, and managing exemptions effectively, you can navigate the complexities of sales tax compliance and focus on growing your dealership.

Deductible expenses and tax credits

There are several tax credits that auto dealerships can leverage to reduce overall taxes including the Work Opportunity Tax Credit, Alternative Fuel Vehicle Refueling Property Credit, Section 179D deduction, and the Investment Tax Credit for Solar Energy. Below is a summary of each credit, eligibility criteria, and details on the potential tax saving.

- Work Opportunity Tax Credit – This is a federal tax credit available to employers that hire individuals from disadvantaged groups such as veterans, summer youth employees, long term family assistance recipients and more. Employers must apply for and receive certification proving the new hire is a member of an eligible group before the credit can be claimed. Once certification is obtained, the credit can be claimed as a general credit against federal income taxes. The credit is generally worth 40% of up to $6,000 in wages paid during the first year of employment to those that have performed at least 400 hours of work.

- Alternative Fuel Vehicle Refueling Property Credit – This is a federal tax credit available to businesses that install qualified refueling or recharging property, including electric vehicle charging equipment, in an eligible location. To qualify the equipment must have original use that began with the taxpayer, be used primarily in the US, and for businesses be used as depreciable property.

Year-End Planning Strategies

It’s off to the races when the new year comes along. New goals, new strategies, and new opportunities. Take the time now to get yourself and your business set up for success, so you don’t get left behind when that “new year motivation” hits.

The Basic Year-End Checklist For Dealerships

Tie up these loose ends before the new year begins. These are simple things you can do, and likely already have been doing, to make sure you are focusing on strategy rather than housekeeping tasks.

- Prepare all bank reconciliations

- Review and research outstanding items for potential year-end adjustments

- Report unclaimed property to state agencies

- Write off any uncollectible balances

- Record finance chargebacks in December

- Record the December LIFO estimate. Make sure to include any floorplan units in transit to help mitigate any LIFO recapture

- Write down used vehicles (probably a safe bet your used vehicles have taken a significant decrease in value over the past couple months)

The Tax-Planning Checklist For Dealers

These items are essential for tax planning purposes.

- Continuing to maximize the 20% Qualified Business Income deduction is key to minimizing your taxes in 2025.

- Take advantage of all Bonus depreciation (only 60% in 2024) and Section 179 depreciation. Make sure you have a capitalization policy to expense minimal purchases to repairs and maintenance.

- With the increase in the standard deduction, your more common itemized deductions have lost value. Consider bunching deductions like charitable contributions. We’ve seen taxpayers doubling their donations to their favorite charities this year, so they get above the standard exemption- and forgoing next year’s gift.

- For businesses treated as partnerships or S corporations for tax purposes, consider any available state pass-through entity tax election.

Insider Tips For Best Reporting & Compliance Practices

We have just a few items of note on your reporting and compliance measures.

- All individuals who are given a demo vehicle should sign a written demonstrator policy agreement. Brady Ware can help you identify the best option because the IRS has approved four different methods.

- Travel expenses are deductible in full, but certain meal expenses are limited. Costs related to holiday parties, customer snacks, promotions, and on-site employee meals are not limited but should be posted to a separate account. In 2024, all restaurant business related meal expenses are back to 50% deductible.

- Include shareholder health insurance premiums paid and HSA contributions on W-2 for shareholders greater than 2%. Your payroll provider can help with this. Make sure to communicate with them prior to year-end that these adjustments will need to be included on the W-2s. The deduction for these items is then taken on the shareholders tax return.

- Review W-9s for 1099 reporting.

- Remember entertainment expenses are not deductible. This includes expenditures for amusement (ex. sporting events), recreation, and membership dues.

2025 Tax Updates for Dealerships

Section 163(j) Limitation Changes: A New Math Problem for Interest Deductions

Let’s talk numbers. The calculation for the Section 163(j) interest deduction can be tricky:

- Goodbye, EBITDA. Hello, EBIT. The interest deduction limit is now based on 30% of EBIT (Earnings Before Interest and Taxes), not EBITDA (which includes depreciation and amortization). That means fewer deductions for businesses with high depreciation costs—like auto dealerships.

- The Bright Side: Floor Plan Interest Stays Fully Deductible. If you’re using floor plan financing to stock your inventory, this interest remains 100% deductible. To maximize your benefits, review your financing structure and consider reallocating debt to make the most of this exclusion.

Bonus Depreciation Phase-Down: Timing Is Everything

The window to take advantage of bonus depreciation is closing- fast. This coming tax season (for the 2024 tax year) the rate dropped to 60% for qualified property. This includes dealership upgrades, machinery, and fleet vehicles.

- Pro Tip: If you’re planning big investments, act now. The depreciation is set to decrease over the next two years. Lock in purchases before year-end to capture the higher depreciation rate. Not ready? No worries, Section 179 expensing might still have your back.

Commercial Clean Vehicle Credit (Section 45W): Bigger Incentives for Going Green

Thinking about adding EVs to your fleet? The Section 45W credit is here to help.

- For Heavyweights: If your fleet includes vehicles over 14,000 lbs, you can snag a credit of up to $40,000 per vehicle.

- For Lighter Rides: Lighter EVs (under 14,000 lbs) still qualify for $7,500.

- Charging Up: Install EV charging stations to support your fleet, and you’ll get an additional tax credit for the infrastructure. It’s a win-win for your bottom line and sustainability goals.

Alternative Fuel Refueling Property Credit (Section 30C): Doubling Down on EV Infrastructure

With more customers and businesses moving toward EVs, dealerships investing in charging stations stand to benefit in a big way. Updates to Section 30C sweeten the deal:

- Higher Credit Caps: In low-income or rural areas, you can now claim 50% of installation costs—up to $200,000 per station (that’s double the previous limit).

- More Locations Qualify: New, more flexible criteria mean more dealerships can tap into this expanded credit.

Leveraging Dealership Management Systems (DMS)

Dealership Management Systems (DMS) are the technological backbone of modern auto dealerships, playing a critical role in financial oversight, operational efficiency, and compliance. A DMS supports financial management by consolidating vehicle sales, service operations, inventory tracking, parts management, and customer data into a centralized platform. This integration provides real-time access to financial metrics, which improves decision-making and simplifies day-to-day operations.

When integrated effectively with accounting software, a DMS eliminates the need for duplicate data entry and ensures that transactions—from receivables and payables to payroll and tax entries—flow seamlessly into the general ledger. This integration reduces human error, saves time, and creates a more accurate financial picture, particularly during monthly closes and year-end reporting. Many DMS platforms also offer robust reporting tools that generate automated dashboards, customizable financial statements, and department-level profitability reports. These tools empower dealership leaders to spot trends, control expenses, and align department performance with strategic goals.

The decision to choose a DMS vendor should be guided by dealership size, complexity, and future growth expectations. Considerations include the system’s ease of use, integration flexibility, support for multi-location operations, scalability, and the quality of customer support. It’s also essential to assess how well the DMS complies with industry security and data privacy standards, especially as cyber threats to dealerships continue to grow. Ultimately, a well-chosen DMS not only streamlines dealership operations but also provides the financial intelligence needed to sustain profitability and compliance in a competitive automotive market.

Profitability Strategies

Profitability strategies in auto dealerships hinge on understanding, optimizing, and aligning all aspects of the business toward sustainable financial performance. This involves dissecting the financial contribution of each department, maximizing revenue opportunities within existing operations, minimizing waste and inefficiencies, and continuously measuring performance against industry norms. These efforts are interdependent and should be addressed holistically for optimal results.

Evaluating department-level profitability begins with separating financial performance by core revenue centers—typically new vehicle sales, used vehicle sales, service, parts, and finance and insurance (F&I). Each of these departments has unique revenue streams, cost structures, and margin opportunities. By analyzing profitability on a department-by-department basis, dealership management can determine which operations are high-performing and which require attention. For example, a profitable service department might be subsidizing a weak used vehicle department, which signals the need for targeted improvements rather than overall cost-cutting. Key metrics to assess include gross profit, net profit, fixed coverage ratio, and departmental contribution to overall dealership profitability.

Improving gross margins through F&I, upsells, and service is a key driver of enhanced dealership performance. In F&I, profitability can be boosted by increasing product penetration rates for extended warranties, GAP insurance, maintenance packages, and vehicle protection plans. Training finance managers to present these offerings clearly and compliantly is critical. In service and parts, profitability hinges on increasing customer-pay work, improving technician productivity, and minimizing warranty or comeback work. Offering upsells during vehicle purchases—such as accessories or premium service packages—also enhances gross margins without significantly increasing operational costs.

Reducing operational inefficiencies focuses on trimming expenses that do not contribute to profit and streamlining internal processes. Common inefficiencies include excessive staffing in administrative roles, slow parts procurement, outdated DMS or CRM systems, and manual paperwork that could be automated. Dealers should assess payroll-to-gross profit ratios, review vendor contracts, reduce utility and facility expenses, and optimize inventory turns to lower carrying costs. Modern DMS platforms can help centralize data, automate routine tasks, and support better decision-making through real-time reporting and analytics.

Benchmarking against industry averages is essential for setting realistic performance goals and identifying outliers in cost and revenue performance. Organizations like NADA, NIADA, and 20 Groups provide benchmarks on gross margins, sales per employee, service absorption, average repair order (RO) values, and other KPIs. By comparing internal performance to these metrics, dealerships can gauge competitiveness and prioritize strategic initiatives. For example, if a dealership’s F&I profit per vehicle retailed is significantly below the national average, it may signal missed opportunities in product presentation or pricing.

Ultimately, profitability strategies should be revisited regularly, especially as market conditions, consumer behavior, and operating costs evolve. A dealership that continuously evaluates departmental performance, enhances margin opportunities, eliminates inefficiencies, and aligns with best-in-class benchmarks is well-positioned for long-term financial health.

Accounting Resources for Car Dealerships

Here’s a collection of valuable accounting resources specifically tailored for car dealerships, including guidance, tools, and reference materials that dealership owners, CFOs, and controllers can use to improve financial management, stay compliant, and boost profitability.

- National Automobile Dealers Association (NADA) Resources

The NADA provides one of the most robust sets of accounting resources for dealers. Their “NADA Dealership Accounting Guide” is an industry standard. It covers proper use of the NADA Chart of Accounts, accounting processes for departments (new vehicles, used vehicles, parts, service, F&I), floor plan financing, and internal controls. They also release quarterly financial profiles that provide benchmarking data. - NADA Chart of Accounts

This is the uniform accounting standard widely used by franchised dealerships across the U.S. It helps ensure consistent categorization of revenues, expenses, and departmental performance, which is critical for internal reporting and for aligning with manufacturer reporting requirements. CPA firms specializing in dealerships often recommend adhering closely to this chart. - Dealership-Specific Accounting Software

While DMS (Dealer Management Systems) handle operations, accounting tools often integrate or support better reporting:

- CDK Dealership Experience – This comprehensive software platforms has solutions to drive profitability through the integration of different modules from the Foundations Suite to the Intelligence Suite and comes with a robust dealership accounting functionality.

- Dealertrack DMS – This comprehensive suite of connected solutions provides the needed solution for managing dealerships of varying sizes. Designed by Cox Automotive, it includes a powerful dealership accounting suite.

- QuickBooks + Automotive DMS Integrations – while not ideal for large, franchised dealers, some smaller independent dealerships use QuickBooks combined with DMS systems like Frazer or AutoManager.

- AutoMate – Provides a comprehensive dealership management solution that touches all aspects of operation from the sales floor to the service department. It includes an integrated CRM solution and robust accounting solution as well.

Contact Brady Ware

Brady Ware provides compliance and advisory services for car dealerships. To learn more about our auto dealership accounting services, complete the form below and a team member will follow up shortly.