Business Valuations

Discover More about Business Appraisals

Jump to the area of greatest interest:

- Introduction

- What are Business Valuations?

- Types of Business Valuations

- Factors Impacting Business Valuations

- Steps in the Valuation Process

- Types of Valuation Deliverables

- Frequently Asked Questions

- Brady Ware Valuation Services

Introduction

A business valuation provides an independent assessment of the value of a company or business interest using the established asset, market or income-based approaches. A business appraisal evaluates several factors depending on the type of business including financial metrics, industry trends, market conditions and more. An independent assessment of value helps owners, investors, and stakeholders make informed decisions about financial planning transactions and legal matters. In fact, this information is critical to strategic decision making because it can impact several areas including tax and financial reporting. A well-executed valuation can provide clarity, transparency, and confidence in negotiations, financial structuring, and compliance.

Who Needs a Business Valuation?

Several individuals and entities benefit from business valuation, including:

- Business Owners – To assess the value of their business for strategic planning, selling, or securing financing.

- Investors & Lenders – To determine a company’s financial health and potential return on investment.

- Legal & Tax Professionals – For estate planning, divorce settlements, tax compliance, and legal disputes.

- Buyers & Sellers – To negotiate fair pricing in mergers and acquisitions (M&A).

- Shareholders & Partners – For equity compensation planning, partnership buyouts, and shareholder agreements.

When is Business Valuation Necessary?

A business valuation is most needed during a transactional event. However, there are a variety of other situations where understanding the value of a business is also necessary, including:

- Mergers & Acquisitions (M&A) – To assess the worth of a company before buying, selling, or merging with another business.

- Litigation & Legal Disputes – In cases such as shareholder disputes, divorce settlements, and tax disputes, a business valuation ensures a fair resolution.

- Succession & Estate Planning – Business owners planning to transition leadership or pass down a business need an accurate valuation for estate and tax purposes.

- Financial Reporting & Compliance – Valuation is often required for tax compliance, financial audits, and regulatory filings.

- Financing & Investment Decisions – Lenders and investors use valuation to evaluate risk and potential returns before funding a business.

Who Performs a Business Valuation?

There are several key valuation certifications that professionals can obtain to demonstrate their expertise in business valuation. Each certification has its own requirements, industry recognition, and applications. Here’s a summary of the major valuation certifications:

- Certified Valuation Analyst (CVA) – This credential is issued by the National Association of Certified Valuators and Analysts (NACVA) and is one of the most recognized valuation credentials. It is designed to help CPAs and other financial professionals build on existing knowledge and provide the education and practical training necessary to specialize in valuations. To obtain certification the candidate must have a business degree, complete valuation course work, accrue practical experience, and pass a comprehensive exam.

- Accredited in Business Valuation (ABV) – This credential is issued the by American Institute of Certified Public Accountants (AICPA) and is specifically for CPAs that want to specialize in valuations. The focus is targeted on financial reporting, tax planning, and forensic accounting. To obtain certification, the candidate must have a CPA license, valuation experience, complete valuation coursework, and pass a comprehensive exam.

- Certified Business Appraiser (CBA) – This credential is issued by the Institute of Business Appraisers (IBA) and is specifically for those professionals that focus on valuations. It is considered rigorous as it requires detailed reports and case studies to provide the candidate’s practical experience. To obtain certification, a candidate must complete business valuation course work, pass an exam, and submit a valuation report for peer review.

- Accredited Senior Appraiser (ASA) – This credential is issued by the American Society of Appraisers and is the most highly regarded credential in the industry. It requires significant practical experience and several peer-reviewed valuation reports. To obtain certification, the candidate must have five years of full-time business valuation experience, pass several exams, and provide valuations for peer review.

What are Business Valuations?

Business valuation is the process of determining the economic value of a company or business entity. It involves analyzing financial data, market conditions, assets, liabilities, and other factors to estimate the worth of a business. Valuations are often conducted using various methodologies, including the income approach, market approach, and asset-based approach, each providing different perspectives on a company’s value.

Common Scenarios Requiring Business Valuation

Business valuations are essential in several situations where an accurate understanding of a company’s worth is required. Some of the most common scenarios include:

- Mergers and Acquisitions (M&A): Buyers and sellers rely on valuations to negotiate fair deals, set purchase prices, and assess the financial health of the target company.

- Estate and Gift Tax Planning: Business valuation plays a crucial role in estate planning, ensuring proper tax reporting when transferring ownership interests to heirs or gifting shares to family members.

- Financial Reporting: Companies, especially those subject to regulatory oversight, may need valuations for purposes such as goodwill impairment testing, stock-based compensation, or purchase price allocation.

- Divorce Settlements: When a business is considered a marital asset, valuation helps in determining fair distribution during divorce proceedings.

Key Stakeholders in the Business Valuation Process

Several parties are involved in the business valuation process, each with their own interests and roles:

-

- Business Owners & Shareholders: They may require a valuation to assess their company’s financial standing, facilitate sales, or for succession planning.

- Investors & Buyers: Potential investors or acquirers use valuations to gauge a company’s potential return on investment.

- Legal and Financial Advisors: Attorneys, accountants, and financial consultants provide guidance on valuation methodologies, tax implications, and legal considerations.

- Regulatory Authorities: Government agencies, such as the IRS and SEC, may require business valuations for tax filings, compliance, and financial disclosures.

- Courts & Mediators: In cases involving disputes, such as divorce or shareholder disagreements, courts may rely on valuations to determine fair settlements.

A business valuation is a critical financial tool that impacts various strategic, legal, and financial decisions, making it essential for business owners, investors, and stakeholders to understand its significance.

Looking for Assistance with a Valuation?

Regardless of the reason, our team assists attorneys and business owners, uncover an independent assessment of business value.

Types of Business Valuations

Market Approach – This approach is a method used to determine the value of a business or business interest by comparing the market prices of comparable business that have either recently sold or are still on the market. Under this approach price-related indicators should as sales, book values, and price-to-earnings are relied upon as evidence of value. Types of evidence often include:

![]()

- Selecting Comparable Companies: The foundation of the market approach lies in identifying suitable comparable. These should be companies within the same industry with similar business models, customer bases, products/services, and financial profiles. Key factors to consider include industry classification, revenue size, growth rates, profitability margins, and competitive positioning. Careful selection of comparable is crucial for the accuracy and reliability of the valuation.

- Identifying and Applying Valuation Multiples: Once suitable comparable are identified, appropriate valuation multiples are calculated. Common multiples include price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and enterprise value to EBITDA (EV/EBITDA). These multiples reflect the market’s perception of the value of a company relative to its earnings, revenue, or cash flow. The selected multiples are then applied to the subject company’s financial metrics to derive an implied valuation.

- Adjusting for Differences: Direct comparisons between companies are rarely perfect. Significant differences between the subject company and its comparable often exist. These differences, whether qualitative (e.g., growth prospects, competitive advantages, risk factors, management quality) or quantitative (e.g., revenue growth, profitability margins, financial leverage), must be carefully analyzed and adjusted for. This ensures that the valuation reflects the unique characteristics and circumstances of the subject company.

- Data Sources and Reliability: The accuracy of the market approach valuation hinges on the quality and reliability of the data used. Reliable data sources include financial databases (e.g., Bloomberg, Refinitiv, FactSet), SEC filings (10-K, 10-Q), and industry publications. It is essential to verify the accuracy and consistency of the data to avoid misleading results.

- Limitations of the Market Approach: While valuable, the market approach has inherent limitations. Finding truly comparable companies can be challenging, especially for companies in niche industries or with unique business models. Market data can be volatile and subject to fluctuations, potentially impacting the accuracy of the valuation. Moreover, the market approach may not fully capture the unique value drivers and intangible assets of the subject company, such as strong brand equity, intellectual property, or a highly skilled workforce.

- Importance of Professional Judgment: The market approach requires significant professional judgment and expertise. Experienced valuators play a crucial role in selecting appropriate comparable, making necessary adjustments, interpreting market data, and considering the limitations of the approach. They must also exercise sound judgment in reconciling the results of the market approach with other valuation methods, such as the income approach and the asset-based approach, to arrive at a comprehensive and defensible valuation.

By carefully considering these factors, practitioners can effectively apply the market approach to valuation, providing valuable insights into the worth of a company. However, it is crucial to remember that the market approach is just one of several valuation methods, and its results should be interpreted in conjunction with other relevant analyses and considerations.

Asset Approach – The asset-based approach to valuation determines a company’s worth by assessing the value of its underlying assets. It focuses on the intrinsic value of a company’s assets, rather than its future earnings potential or market comparisons. This approach involves comprehensively identifying and valuing all company assets, both tangible (e.g., property, plant, equipment, inventory) and intangible (e.g., patents, trademarks, goodwill). Tangible assets may be valued using methods like market value, replacement cost, or liquidation value, while intangible assets often require more complex valuation techniques, such as income-based methods or market-based methods.

![]()

Crucially, the book values of assets on the balance sheet may not accurately reflect their fair market values. Adjustments are necessary to account for current market conditions, obsolescence, and other relevant factors. For example, property may need to be revalued based on recent appraisals, and equipment may need to be adjusted for depreciation and obsolescence.

Furthermore, liabilities must be carefully assessed and valued to determine their impact on the company’s net asset value. Liabilities may include debts, accrued expenses, and other financial obligations. Accurate determination of the fair market value of liabilities, considering factors such as interest rates and credit risk, is essential.

Once the values of all assets and liabilities have been determined, the net asset value is calculated by subtracting total liabilities from total assets. This represents the theoretical value of the company if it were to liquidate its assets and pay off all its debts.

Asset Approach Limitations

However, the asset-based approach has limitations. It may not fully capture the value of intangible assets, such as goodwill, brand equity, and customer relationships, which can significantly contribute to a company’s overall value. It may also not accurately reflect the company’s future earning potential, a crucial factor for many businesses. This approach is generally less relevant for companies with significant intangible assets or those whose primary value drivers are not directly tied to their physical assets.

The asset-based approach is most suitable for valuing asset-heavy companies, such as real estate companies, manufacturing companies with significant tangible assets, and companies in the natural resource extraction industry. It can also be useful in situations where the company is experiencing financial distress or is being liquidated.

The asset-based approach provides a valuable perspective on a company’s worth by focusing on the value of its underlying assets. However, it’s crucial to recognize the limitations of this approach and consider other valuation methods, such as the income approach and the market approach, to obtain a more comprehensive and accurate valuation.

Income-Based Approach

This approach recognizes that the value of a business lies in its capacity to produce future income streams. Therefore, it seeks to estimate the present value of those future cash flows by discounting them back to their current worth using an appropriate discount rate. This discount rate reflects the risk associated with the investment and the required rate of return for investors.

![]()

Key Methods:

- Discounted Cash Flow (DCF) Analysis: This is the most common method within the income approach. It involves projecting the company’s future cash flow over a specific period (typically 5-10 years) and then discounting those cash flows back to their present value using a discount rate that reflects the risk associated with the investment.

- Capitalization of Earnings: This method is suitable for mature companies with stable and predictable earnings. It involves capitalizing current earnings (net income or free cash flow) by dividing them by a capitalization rate. The capitalization rate reflects the required rate of return for investors in similar companies.

Key Considerations:

- Accurate Financial Projections: The accuracy of the income approach heavily relies on the accuracy of the projected future cash flow.

- Discount Rate Selection: Selecting the appropriate discount rate is crucial. It should reflect the risk associated with the investment, including factors such as industry risk, competitive risk, and the company’s financial leverage.

- Terminal Value: The income approach typically involves estimating a terminal value, which represents the value of the company’s cash flow beyond the explicit forecast period.

- Assumptions and Sensitivity Analysis: The income approach relies on numerous assumptions, such as revenue growth rates, expense levels, and the discount rate. Conducting sensitivity analysis to assess the impact of changes in these key assumptions on the valuation is essential.

The income approach provides a valuable perspective on a company’s worth by focusing on its future earning potential. However, it’s crucial to recognize the limitations of this approach and consider other valuation methods, such as the market approach and the asset-based approach, to obtain a more comprehensive and accurate valuation.

Factors that Affect Business Valuations

A business valuation is influenced by multiple factors that collectively shape its perceived worth. These factors determine the potential future earnings, risk exposure, and overall financial stability of a business, which, in turn, influence how much an investor, buyer, or stakeholder would be willing to pay for it.

Financial Performance

Financial performance is one of the most critical drivers of business valuation, as it reflects a company’s ability to generate revenue, control costs, and maintain profitability over time.

- Revenue Trends – Revenue trends indicate whether a business is growing, stable, or declining. A company with consistent or increasing revenue is generally valued higher because it suggests strong demand for its products or services and a sustainable business model. On the other hand, declining revenues signal potential challenges, such as market saturation, competitive pressures, or operational inefficiencies, which can lower the valuation.

- Profit Margins – Profit margins—both grow and demonstrate a company’s ability to convert revenue into actual profit. Higher margins indicate operational efficiency and pricing power, leading to a stronger valuation. Investors prefer businesses with healthy and stable profit margins because they show resilience against market fluctuations and an economic downturn. A company with razor-thin margins, even with high revenue, may receive a lower valuation due to the increased risk of financial instability.

Market Conditions

External market conditions significantly influence valuation, as they determine the competitive landscape and growth potential of an industry.

- Industry Growth – Businesses in fast-growing industries, such as technology or renewable energy, often receive higher valuations because of their expansion potential and investor interest. A stagnant or declining industry, however, can negatively impact valuation as it limits future opportunities and raises concerns about long-term sustainability. Even a well-managed company may see its valuation suppressed if it operates in a sector with little to no growth.

- Competitive Landscape – The level of competition within an industry also affects valuation. Companies with a dominant market position, strong brand recognition, or a unique value proposition often receive premium valuations. In contrast, businesses in highly saturated markets with low differentiation may face pricing pressure and reduced profitability, leading to lower valuation multiples.

Business Assets

The assets a business owns—both tangible and intangible—directly impact their valuation, as they contribute to its ability to generate revenue and sustain operations.

- Tangible vs. Intangible Assets – Tangible assets, such as real estate, machinery, and inventory, provide measurable value and can serve as collateral for loans or liquidation value in case of a sale. Businesses with significant tangible assets often receive higher valuations in asset-based valuation approaches. Intangible assets, such as brand reputation, patents, proprietary software, and customer relationships, can add significant value, particularly in industries where intellectual property or brand strength is a major competitive advantage. Companies with strong intangible assets—such as a globally recognized brand or patented technology—often command higher valuations than those relying solely on physical assets.

- Intellectual Property (IP) – IP, including patents, trademarks, copyrights, and trade secrets, can be a substantial driver of business value. A company with a strong IP portfolio can maintain a competitive edge, generate licensing revenue, and create barriers to entry for competitors. For example, a biotech firm with patented drug formulas will likely have a much higher valuation than a generic pharmaceutical manufacturer. However, IP valuation depends on enforceability, market relevance, and the remaining lifespan of protections.

Risk Factors

Risk is a crucial consideration in valuation, as it determines the level of uncertainty associated with future earnings and operational stability.

- Market Risk – Market risk includes external economic factors such as inflation, interest rates, and regulatory changes that can impact a business’s performance. A company in a highly cyclical industry, such as construction or oil and gas, may see valuation fluctuations based on commodity prices or economic downturns. High market risk leads to lower valuation multiples, as investors demand a higher return to compensate for uncertainty.

- Operational Risk – Operational risk refers to internal factors that can disrupt business operations, such as supply chain dependencies, reliance on key personnel, or outdated technology. A company heavily reliant on a single supplier or a small group of customers may face a lower valuation due to the increased vulnerability to disruptions. Conversely, businesses with diversified supply chains, scalable operations, and strong leadership teams often receive higher valuations due to their lower operational risk.

- Financial Risk – Financial risk includes factors like debt levels, cash flow volatility, and creditworthiness. Companies with high debt burdens may have lower valuations because of the added financial strain and interest obligations. Stable cash flow and low debt levels generally lead to a higher valuation, as they indicate financial resilience and the ability to invest in growth opportunities. Investors and buyers assess financial risk carefully to determine whether a business can sustain operations and generate consistent returns without excessive financial leverage.

The valuation of a business is a complex process that takes into account multiple interrelated factors. Strong financial performance, favorable market conditions, valuable assets, and low-risk exposure contribute to a higher valuation. Conversely, weak revenue trends, industry stagnation, reliance on physical assets with limited growth potential, and high operational or financial risks can lower valuation outcomes. Understanding these factors help business owners, investors, and buyers make informed decisions about business worth and potential investment opportunities.

The Future of Business Valuation

The future of business valuation is likely to be shaped by a number of factors, including technological advancements, evolving market dynamics, and increasing regulatory scrutiny. We can expect to see greater integration of AI and ML into the valuation process, leading to more efficient and data-driven valuations. The focus on intangible assets will continue to grow, requiring valuation professionals to develop new and innovative approaches. Furthermore, as businesses become increasingly global and complex, the demand for specialized valuation expertise will likely increase. The future of business valuation will require professionals to possess a deep understanding of both traditional valuation methods and emerging technologies, as well as the ability to adapt to a constantly changing environment. It will be a field that continues to blend art and science, requiring both analytical rigor and sound judgment.

Looking For Assistance with a Valuation?

Our business valuation team consistently provides proprietary insights because we deliver a proven process for evaluating critical decisions. This special and unique insight to help make decisions have a profound impact on businesses. Incorporating this access into your daily decision process creates advantage from what used to be pain points and barriers.

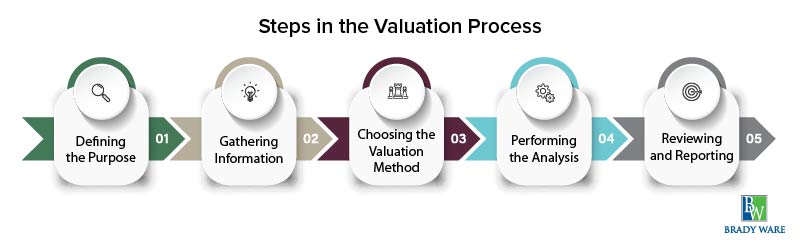

Steps in the Business Valuation Process

- Defining the Purpose of Valuation – The first step is to clearly define the purpose of the valuation. This involves understanding the specific reasons for the valuation, such as legal needs (estate and gift tax planning, divorce proceedings, legal disputes), financial needs (mergers and acquisitions, initial public offerings (IPOs), private equity investments), or strategic needs (business planning, financial reporting, employee stock ownership plans (ESOPs)).

- Gathering Information – This crucial step involves collecting comprehensive financial and operational data about the business. This typically includes financial statements (income statements, balance sheets, cash flow statements, and tax returns for several years), business structure and history, industry data, market research reports, legal and contractual agreements, and operational data such as sales and marketing data, customer information, and employee data.

- Choosing the Valuation Method – Selecting the appropriate valuation method(s) is a critical decision. The choice depends on the purpose of the valuation, the nature of the business, and the availability of data. Common methods include the income approach (discounted cash flow analysis, capitalization of earnings), the market approach (comparable company analysis, precedent transactions analysis), and the asset-based approach (cost approach, liquidation value).

- Performing the Analysis – This step involves applying the selected valuation methods to the gathered data. This may involve financial projections, developing forecasts of future revenue, expenses, and cash flows; market research, identifying and analyzing comparable companies; asset valuation, appraising tangible and intangible assets; and risk assessment, evaluating the risks and uncertainties associated with the business.

- Reviewing and Reporting – The final step involves reviewing the analysis, drawing conclusions, and preparing a comprehensive valuation report. The report should include the purpose of the valuation, scope of work, valuation methods used, key assumptions and data sources, valuation conclusions and supporting analysis, and qualifications and limitations of the valuation. The valuation report should be clear, concise, and well-supported by the analysis and data.

Types of Valuation Deliverables

Business valuation work products can take one of several forms. They can be long, highly detailed, and technical documents, and they can be brief summaries. In some cases, there may be no written deliverable at all. The form that a business evaluation takes will depend on its intended use and audience.

Appraisal Reports

An appraisal report is a self-contained document that describes the procedures applied, information considered, and analyses performed to achieve the conclusion of value. If written well, the reader of an appraisal report should be able to understand every facet of the valuation, even if the reader has minimal financial training and no prior familiarity with the company. In theory, this document is appropriate to be used by anyone the client chooses to designate. Most appraisal reports are 40-60 pages in length, and some may be considerably longer. Appraisal reports (or some variant) are almost always required in Federal Court cases, IRS gift or estate tax returns (they are called “Qualified Appraisals”), and employee stock ownership plan (ESOP) valuations. Appraisal reports are typically desirable for resolving shareholder buyouts, as a tool for buy-side due diligence, and to aid business owners with strategic planning.

Restricted Reports

A restricted report is a summary document that states the procedures applied, information considered, and analyses performed to achieve the conclusion of value. While the procedures and rigor in the development of the business appraisal are identical to those that support the appraisal report, the restricted report condenses the narrative to the bare essentials and carries with it the implicit assumption that the reader already understands the nature of the company and its business, and has a sufficient grounding in accounting, finance, and economics to mentally make the links that an appraisal report would typically make for the reader. Restricted reports are common for situations such as 409a (stock option) valuations, fair value accounting valuations, and valuations for civil litigation in state courts, mediations, and arbitrations. Restricted reports are often used for sell-side strategic engagements as well.

Generally, professional standards recognize four business valuation deliveries:

- An appraisal report

- A restricted (or summary) report

- An oral report

- A calculation report

Oral Reports

Oral reports are valuation reports that are delivered as voice presentations only. Some exhibits may be presented, but the most important substance of the report lies in the oral presentation. Oral reports are typically called for when either the client determines that a written work product is superfluous, or they wish to avoid the creation of a written record of the valuation result. Oral reports are most associated with litigation, and in some cases, the testimony of a business valuation expert witness in deposition or at trial may be considered an oral report.

Calculation Reports

Calculation reports fall short of appraisal reports in that the report does not supply a conclusion of value but rather a calculation result. Calculation engagements are sometimes alternatively called limited procedure engagements because, in contrast to business valuation projects, which must allow any procedure that the appraiser deems appropriate, calculation engagements take place under limitations specified in advance of the engagement by the client. The client defines the parameters of the calculation and the valuation procedures to be applied. There is no opinion, either explicit or implicit, of the company’s or subject interest’s value – just a statement of the result of the calculation in accordance with the parameters that the client set forth. Calculation reports are most frequently used for preliminary planning purposes and are commonly referred to as “back of the envelope” valuations.

What format should a business valuation take?

Professional standards envisage a number of formats for a business valuation deliverable. There are no hard and fast rules that tie a report format to a specific purpose or audience, which is a good thing because every valuation assignment is different, and the needs for each assignment are different. There is a business valuation deliverable format for whatever purpose the valuation is serving and whatever audience is expected to rely upon it. The key is, like a tool, choosing the right valuation for the right job.

Frequently Asked Questions – Business Appraisals

What is a business valuation?

A business valuation is the process of determining the economic worth of a company. It involves analyzing various factors to estimate the company’s fair market value.

Why is a business valuation needed?

Business valuations are needed for various purposes, including determining a fair selling price for the business during a sale, evaluating the value of a target company for acquisition, determining the value of a business for estate and gift tax planning, resolving disputes related to business ownership or divorce, supporting financial reporting purposes such as impairment testing or financial statement reporting, and valuing company shares for employee stock ownership plans.

What are the main valuation methods?

The primary valuation methods include the income approach, which values the company based on its expected future earnings (e.g., discounted cash flow analysis); the market approach, which compares the company to similar companies that have recently been sold or are publicly traded; and the asset-based approach, which determines the value of the company based on the value of its underlying assets.

How long does a business valuation take?

The time required for a business valuation can vary significantly depending on several factors, including the complexity of the business, the scope of the valuation, and the availability of information. Generally, it can take from a few weeks to several months.

How much does a business valuation cost?

The cost of a business valuation can vary widely depending on factors such as the size and complexity of the business, the scope of work, the valuator’s expertise, and the geographic location.

Can I perform a valuation myself, or do I need an expert?

While some basic valuation tools are available, engaging a qualified professional is generally recommended for a formal valuation. This is because professional valuators provide an unbiased and objective assessment, possess specialized knowledge and experience in valuation methodologies, and can ensure compliance with industry standards.

What are the key factors that influence business value?

Key factors that influence business value include revenue growth, profitability, market share, competitive advantage, industry trends, economic conditions, and overall risk.

What is the difference between a valuation and an appraisal?

The terms “valuation” and “appraisal” are often used interchangeably. However, “appraisal” typically implies a more formal process that adheres to specific standards, such as the Uniform Standards of Professional Appraisal Practice (USPAP).

When should a business valuation be updated?

Business valuations may need to be updated periodically due to changes in market conditions, company performance, and other relevant factors.

Brady Ware Valuation Services

![]() The complexities of decisions facing businesses are often consequential and hard to reverse. Evidence-based decision systems enable businesses to avoid pitfalls and blunders and successfully capture value opportunities more effectively than more mundane approaches to decision making.

The complexities of decisions facing businesses are often consequential and hard to reverse. Evidence-based decision systems enable businesses to avoid pitfalls and blunders and successfully capture value opportunities more effectively than more mundane approaches to decision making.

Valuation Specialists

Our business valuation team applies rigor and creativity to help business decision-makers clearly see success points, avoiding traps and seizing opportunities more reliably than their competition. Financial interests are protected, risk is mitigated, and complexities are highlighted and simplified as a direct result from improved decision-making, and the complexities of a transaction are grounded in a factual, unbiased, and clear foundation while leveraging real-world data.

Decision Facilitators

Faced with decisions that are critical to be made correctly and with little recourse once made, clients require clarity about the risks, and likely outcomes (compared with desired outcomes) of such decisions. Accordingly, with an expert and creative partner, the right path becomes clear and the best decisions are made. Utilizing empirically validated business valuation methods, Brady Ware helps anticipate the range of outcomes so that your high-leverage decisions are supported with access to the right data, clearly presented and supported by empirical evidence.

From Triggers to Pathways

Decisions are triggers. The client is confronted with an opportunity to commit significant resources to capturing a value possibility, or all that opportunity to pass, possibly to be captured by someone else, even a competitor. Often, hesitation to make a decision stems from a lack of actionable information. And when such a decision is made, it is either made when lacking key information or no decision at all is made, which often means that the definition is taken out of their hands. Our business valuation services provide the pathway to more confident decision-making so that the decision-maker has more impact on the company’s outcomes.